According to Container Xchange, Container prices in China are experiencing huge volatility. The main reasons for this can be summarized as follows:

01/The impact of the Red Sea crisis.

1.the Houthi armed conflict in the Red Sea has led to a significant increase in ship rerouting, resulting in higher port fees, congested shipping routes, and an imbalance in container supply and demand.

On one hand, this extended detour increases travel time by 7-14 days. Transportation costs such as fuel, personnel expenses, container fees, insurance premiums, and port fees in Africa have all risen, causing major shipping companies to pass on these costs to us.

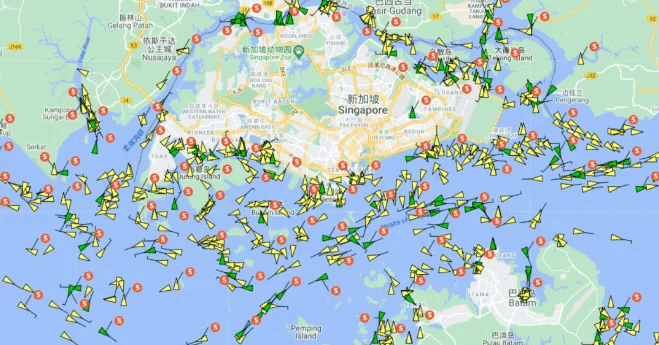

On the other hand, the Red Sea serves as a crucial route through the Suez Canal, where 22% of global containers, 20% of car carriers, 15% of oil tankers, and 6% of bulk carriers pass through the Red Sea-Suez Canal route. Many cargo ships have diverted their routes, disrupting the original balance, and opted to navigate around Africa instead. This has caused congestion in African routes, which were already limited in capacity.Additionally, this year has seen a surge in incoming vessels with longer transit times and increased transshipment ports.

As a result, there is a higher demand for ships to operate longer voyages, leading to containers being left behind and causing an imbalance in supply and demand, further exacerbating the rising costs.The Maersk shipping company, has expressed that the Red Sea crisis has resulted in vessel diversions, leading to a chain reaction of vessel congestion, delays, and equipment and capacity shortages. It is anticipated that the shipping industry will experience a capacity loss of 15-20% in the second quarter for the Far East to Northern Europe and Mediterranean markets.

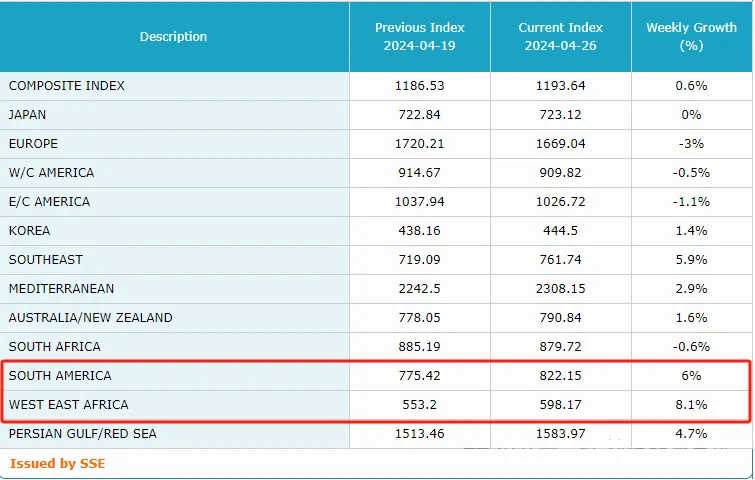

02/Impact of price increase on South American routes.

The trade between China and South America is continuously growing, driven by the strong demand for emerging market orders.

The South America route has achieved double-digit growth for three consecutive weeks, with an increase of 6.0%.

According to the survey, the reason for the increase is that emerging markets such as Brazil and Mexico, as highly populated countries, are becoming important springboards for China’s expansion into the South American and North American markets through regional free trade agreements.

In addition, Brazil’s future increase in tariffs on Chinese new energy vehicles in July, as well as the lack of actual orders, has led many automotive companies to desperately ship to these areas, resulting in insufficient capacity.

As a result, COSCO’s withdrawal of ships running to West Africa and redirecting them to South America has caused a general increase in freight rates in West Africa. At the same time, the storage yards in the destination ports for these new energy vehicles are almost full, further exacerbating the transportation pressure.

03/The US election claims to impose tariffs on China.

The 2024 US presidential election has garnered widespread international attention, with former President Trump making a comeback. He has stated that if elected, he will raise tariffs on Chinese goods to 60% and target China’s automobile industry for future tariff increases. As a result, some importers have started stocking up in advance, causing the peak season to arrive earlier. Shipping companies such as Maersk have announced the implementation of peak season surcharges on multiple routes to South America, India-Pakistan, Africa, and other destinations.

04/The shipping company takes advantage to increase prices.

As the global economy gradually recovers, the strong growth in import and export trade has also supported the recovery of the shipping market.Additionally, influenced by the Red Sea crisis and increased shipping demand in Europe and America, a number of shipping giants including Hapag-Lloyd, MSC, Maersk, HMM, and ONE have announced a price increase plan.

In the face of the imbalanced supply and demand of containers, some leading shipping companies have even raised and resold certain slots, further exacerbating the increase in ocean freight prices.Given the current situation, it is difficult to predict the trend of the shipping market.

We kindly request all customers to plan their shipment arrangements in advance.